Tax system

Taxes in Munich: a crucial topic

Tax ID number, social security deductions, tax classes: The Munich tax system does take some getting used to. Learn about taxation in Munich here!

While we highly recommend getting support from a tax professional (”Steuerberater“), we collected some crucial information about taxes in Munich. Take a look around to get an overview of this important topic.

Munich tax system: what you need to know

When you start working in Germany, it is essential to understand how the system of taxes and social security works, as it might be different from what you are used to. Paying taxes and correctly declaring your income to the “Finanzamt“ (tax office) is mandatory. Tax evasion is a serious offense – with penalties ranging from fines to imprisonment for up to 10 years, depending on the severity. So, get this right!

Here is an overview of what to expect:

Taxes and social security deductions

Your gross salary (the full amount before deductions) will have two main types of deductions taken out:

1. Taxes:

- Income tax: Based on your earnings and tax bracket.

- Church tax: Only if you are registered with a religious organization. Your employer will deduct this ”Kirchensteuer“ - and send it to the tax office.

- Solidarity surcharge: A smaller additional tax, although mostly applicable to higher incomes.

2. Social Security Contributions:

- Health insurance: Funds the healthcare system.

- Pension insurance: Helps build your future retirement benefits.

- Unemployment insurance: Provides financial support in case of job loss.

- Long-term care insurance: Ensures care in case of old age or disability.

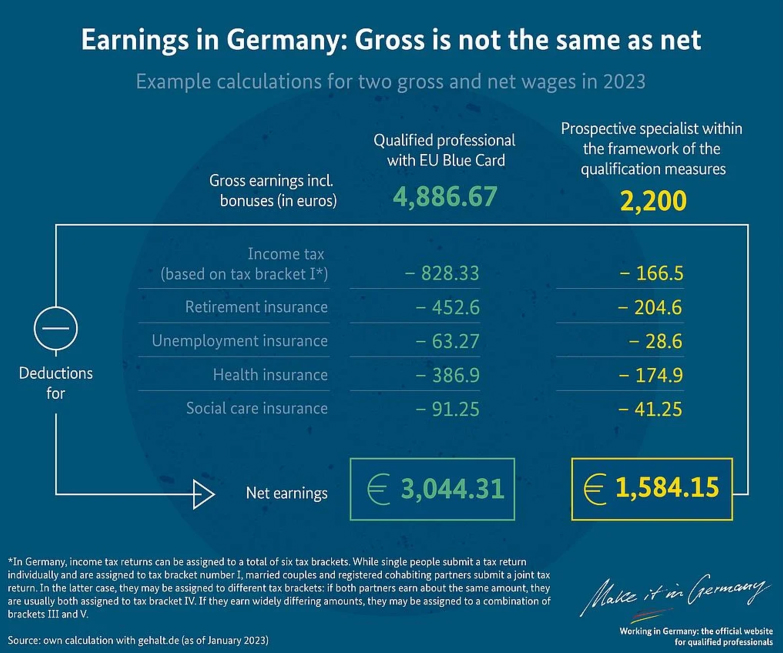

An earnings example

In this graph, you see a simple calculation of deductions.

Net salary

After these mentioned deductions, the remaining amount is your net salary – what you take home each month. Even though deductions reduce your salary, they provide important benefits like healthcare and a future pension.

Tax classes

Your tax bracket (”Lohnsteuerklasse“) is determined by personal factors like marital status or having children. This affects how much income tax is deducted from your salary. You can find more information on the German tax classes and other types of taxes here and on the How to Germany website.

Salary calculators

You can estimate your net salary using online tools:

- Income tax calculator: Helps you calculate deductions based on your gross salary.

- Entgeltatlas and Lohnspiegel: Compare salaries across job categories. Both are in German.

Minimum wage

The statutory minimum wage in Germany is currently 12.82 euros per hour (as of 2025), treated as the minimum fair compensation across all industries.

Tax ID number

Source: Muenchen_Tourismus_Business_Startup_Foto_Christian-Kasper-0768

Everyone who starts working in Germany receives their unique 11-digit Tax ID number. This number serves as your lifelong identifier for income tax purposes. Interestingly, even children born in Germany get their own Tax ID number within three months of birth! This is important for applying for benefits like child allowance (Kindergeld) later.

As you navigate your working life in Germany, you will need to provide your Tax ID number in various situations, such as to your employer.

If you do not know the number, you can ask for it personally at the Meldebehörde (registration office) or in writing from the Bundesamt für Steuern (federal tax office).

Save some money: the German tax return explained

Germany’s annual tax return system allows you to claim various expenses, potentially reducing your tax bill. This could result in a tax refund or a lower tax payment to the tax office (”Finanzamt“).

While not everyone is obligated to file, it’s best to check with the tax office to see if it applies to you. Filing a return can sometimes lead to a refund, so it is worth considering!

Good to know: The City of Munich also charges taxes, for example, dog tax, business tax, or waste disposal fees. You can get help with your calculation, payment, and processing at a glance here (page in German).

If navigating the tax return process feels overwhelming, don’t hesitate to seek assistance: the Munich tax office (”Finanzamt“ – page in German) itself may also be able to answer any questions you have. If not, get yourself a Steuerberater through the VLH (Lohnsteuerhilfeverein Vereinigte Lohnsteuerhilfe e.V. (page in German – you need to become a member first).

- You can find more information about taxes in the “Work and Study” section of our website.

- ”Handbook Germany“ offers more information about tax declaration.

- The ”Integreat app” for Munich offers an overview of the tax system and tax declaration – as well as many useful links.

- Here, you can read more about the German welfare state.

Our Tip

The ”Advice Centres“ run by ”Faire Integration” offer counseling for internationals from third-countries (outside the EU). You can contact them with all questions about employment law, social legislation, or problems you may face at work. Find the contact details for the center in Munich here.